tax return unemployment delay

IR-2021-111 May 14 2021. Since Saturday was 4th of july would there be a delay in the 600 for Monday july 6th.

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Approximately 10million taxpayers may get a 10200 payout if they filed their tax returns before the tax break in.

. The American Rescue Plan Act signed on March 11 included a 10200 tax exemption for 2020. This move from the traditional April 15 filing deadline does not impact. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Tax Refund Problems Region. This couple would exclude 15200 of benefits from tax instead of the full. Lets say one spouse collected 5000 in unemployment benefits in 2020 and the other got 25000.

June 22 2022 202 PM 10 min read. Federal Tax Return Delay Unemployment. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

Tax filing delay. However if as a result of the excluded unemployment compensation taxpayers are now eligible for deductions or credits not claimed on the original return they should file a Form. Press question mark to learn the rest of the keyboard shortcuts.

June 3 2021 Topic. The 10200 is the amount of income exclusion for single filers not the amount of the refund. WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income.

To check the status of your 2020 income tax refund using the IRS tracker tools youll need to give some information. The IRS identified over 10 million taxpayers who filed their tax returns prior to the. You now have until May 17 2021 to file your 2020 individual tax return and pay the tax.

Did not claim CalEITC. Frustrated taxpayers speak out over delays after IRS announced 10200 refund to millions who paid unemployment taxes. Will I Get An Unemployment Tax Refund.

Federal AGI less than 40201 or 50401. When should i expect my tax refund in 2022. Filed your 2020 tax return and.

Already millions of taxpayers have been waiting four or five months for their federal income tax refunds after completing 1040 paper. The agency is juggling the tax return backlog delayed stimulus checks and child tax credit payments. You donât need to do anything.

Even though the chances of speaking with someone are slim you can still try. In the latest batch of refunds announced in november however the average was 1189. Press J to jump to the feed.

Dont expect a refund for unemployment benefits. Unemployment compensation received in 2021 is generally taxable so taxpayers should include it as income on their tax return. Your Social Security number or Individual Taxpayer Identification Number.

A tax break isnt available on 2021 unemployment. If you received unemployment benefits in 2020 a tax refund may be on its way to you. Double-check name birth date and Social.

The amount of the refund will vary per person depending on overall income tax. The IRS has sent 87 million unemployment compensation refunds so far. Visit Wait times to review normal refund and return processing timeframes.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a refund without any additional action from your. Your tax return will be processed with the updated requirements. IRS Unemployment Tax Refund Tax Refund Delay Bureaucracy.

Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College

Many Tax Refunds Are Delayed This Year Here S Why According To The Irs Silive Com

Where S My Tax Refund Irs Holds 29m Returns For Manual Processing

News Delaware Department Of Labor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Refunds Irs Why Is Irs Advising On The Delay Of Tax Return Payments Marca

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Tax Forms For Michigan Unemployment Claimants Now Available Online

Where S My Refund 2021 Tax Returns May Be Delayed

No Tax Refund After 21 Days Reasons Why And Tips On Contacting The Irs To Get An Update For Tax Return Processing Status Aving To Invest

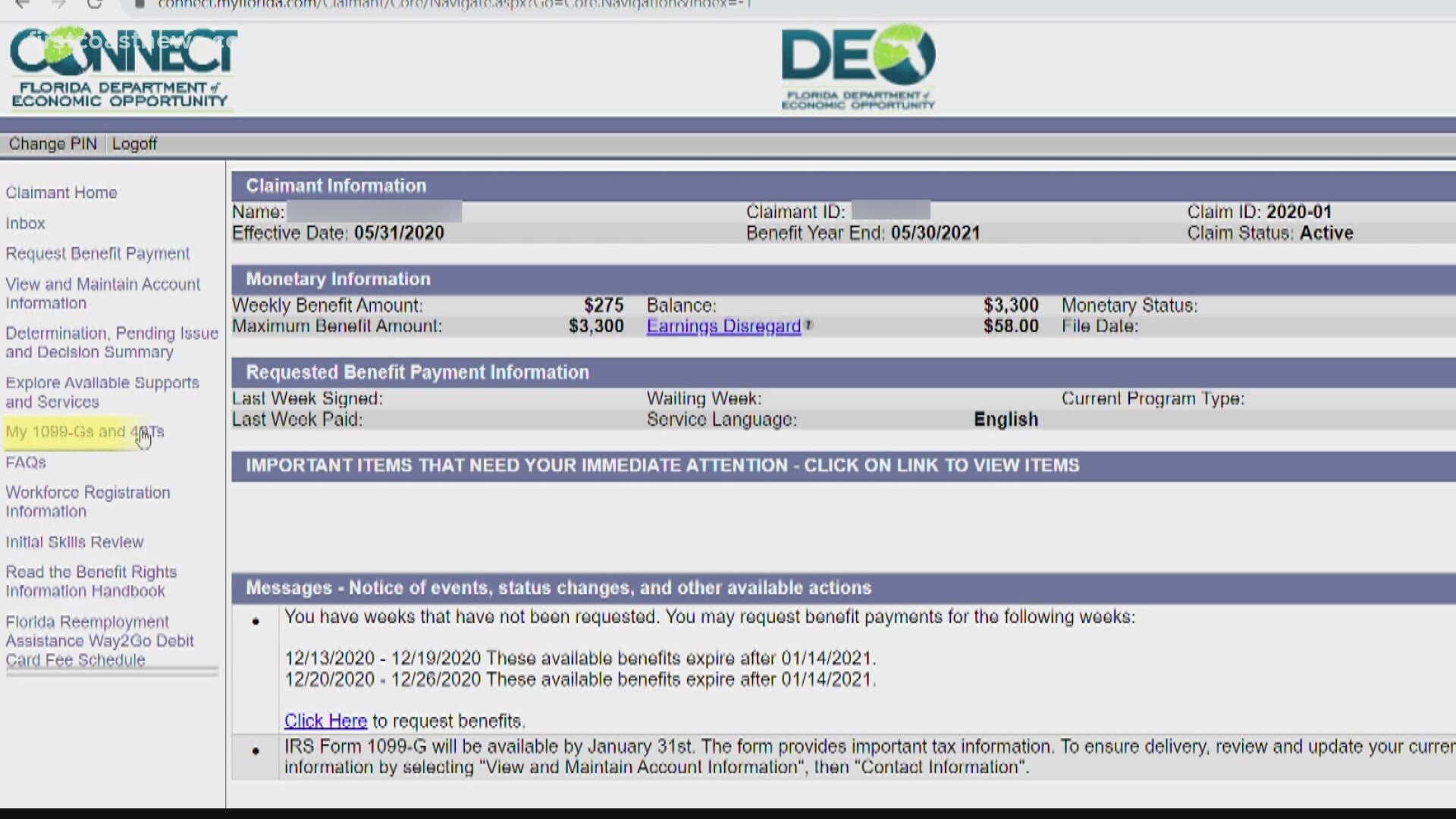

Floridians Report Tax Documents With Inaccurate Information Firstcoastnews Com

Anyone Else Get This Email About Their Return R Irs

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Reasons Why Irs Tax Refunds Delayed For Millions Of Americans Nbc News Now Youtube

Are Unemployment Benefits Taxable Wcnc Com

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

House Democrats Push Irs To Resolve 2022 Tax Return Backlog

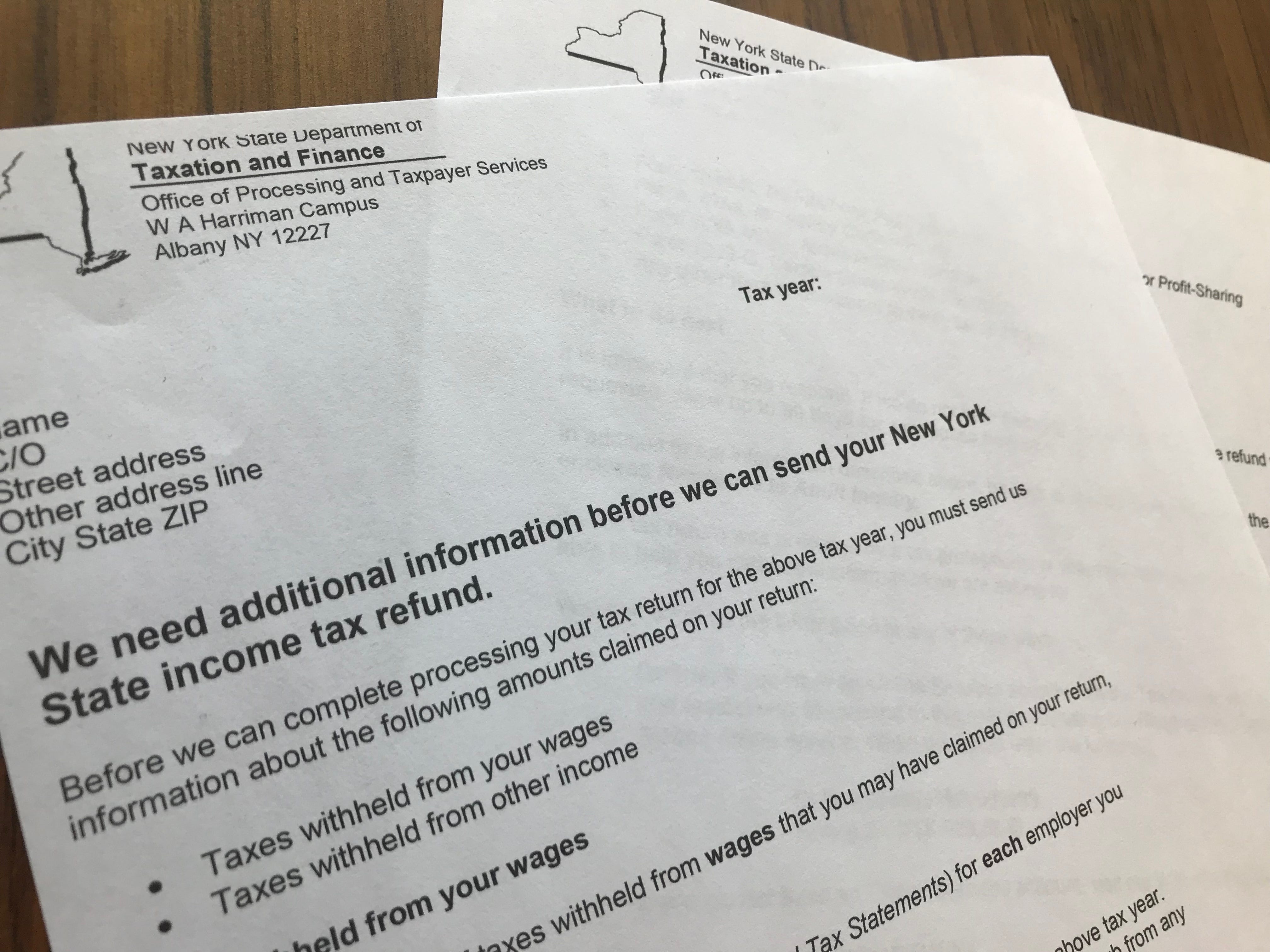

Get An Nys Tax Dept Letter Don T Throw It Out Or You Might Delay Your Refund