geothermal tax credit canada

The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. The 30 federal tax credit was extended through 2032 and will drop to 26 in 2033 and to 22 in 2034 before expiring altogether so act now for the most savings.

Geothermal Heat Pumps Carrier Residential

150 to 2500 for ductless mini-split geothermal centrally-ducted and air-to-water systems Wood and pellet heating.

. The incentive will be lowered to 26 for systems that. Moreover there is a 15 percent tax credit on the remainder of the capital costs of the geothermal system excluding the heat pump. 75 of the purchase price of a heat pump that qualifies.

Geothermal Heating Systems for Homes Domestic Geothermal heating. GEO provides outreach to the industry public and government. The 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032.

Since geothermal systems are the most efficient heating and cooling units available the United States federal government has enacted a 26 federal geothermal tax credit with no. Geothermal - a 75 tax credit on the purchase of a geothermal heat pump and a 15 tax credit on the cost of installation. 500 to 1000 Three-element water heaters.

Manufacturers can claim a 75 tax credit on the adjusted cost of geothermal heat pump systems that meet the standards set by the Canadian Standards Association. A 10 tax credit on the purchase and installation of. The Canada Revenue Agency CRA issues income tax folios to provide a summary of technical interpretations and positions regarding certain provisions contained in income tax.

A 75 percent tax credit is also offered to. The tax credit equals the total of. This credit is available to Ontarians living in northern communities to help offset the higher energy costs faced by those living in the North.

Geothermal - a 75 tax credit on the purchase of a geothermal heat pump and a 15 tax credit on the cost of installation. Atlantic investment tax credit. Eligible applicants could receive up to a.

Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. 15 of the capital cost of geothermal energy equipment excluding the cost of the heat pump. What other expenses arent covered by the tax credit.

The maximum tax credit for fuel cells is 500 for each half-kilowatt of power capacity or 1000 for each kilowatt. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what. A 30 federal tax credit for residential ground source heat pump installations.

On a 100-point EnerGuide rating scale if your home is built to exceed a rating of 80 you will receive a 1500 rebate. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. Homeowners who install geothermal can get the tax credit.

This program helps consumers save up to 25 on products up. The Geothermal Tax Credit is classified as a non-refundable personal tax credit. Geothermal - a 75 tax credit on the purchase of a geothermal heat pump and a 15 tax credit on the cost of installation.

The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023. 254 The Atlantic investment tax credit in subsection 1279 is a credit equal to 10 of the capital cost of prescribed energy generation and.

Geothermal Moves On Without Tax Credits 2017 04 03 Achrnews Achr News

Current Promotions Rebates Comfort Control

South Carolina S Geothermal Heat Pump Tax Credit

Federal Tax Credits Geothermal Heat Pumps Energy Star

Amazon Com Gardeners Vs Designers Understanding The Great Fault Line In Canadian Politics Ebook Crowley Brian Lee Books

Deep Advancing Its 35 Mw Geothermal Project In Saskatchewan Canada

Green Energy Incentives Services Rsm Us

Energy Tax Plan May Start With House S Transition To Senate S Roll Call

Geothermal Investment Tax Credit Extended Through 2023

Geothermal Energy Sustainable Heating And Cooling Using The Ground Rosen Marc A Koohi Fayegh Seama 9781119180982 Amazon Com Books

Geothermal Moves On Without Tax Credits 2017 04 03 Achrnews Achr News

Geothermal Bubbles Up As Another Way To Fight Climate Change The Pew Charitable Trusts

Updated Irs Releases 2022 Section 45 Production Tax Credit Amounts Mayer Brown Tax Equity Times Jdsupra

Geothermal Tax Credits Geostar

Clean Energy Incentives Rebates Canada Updated 2021

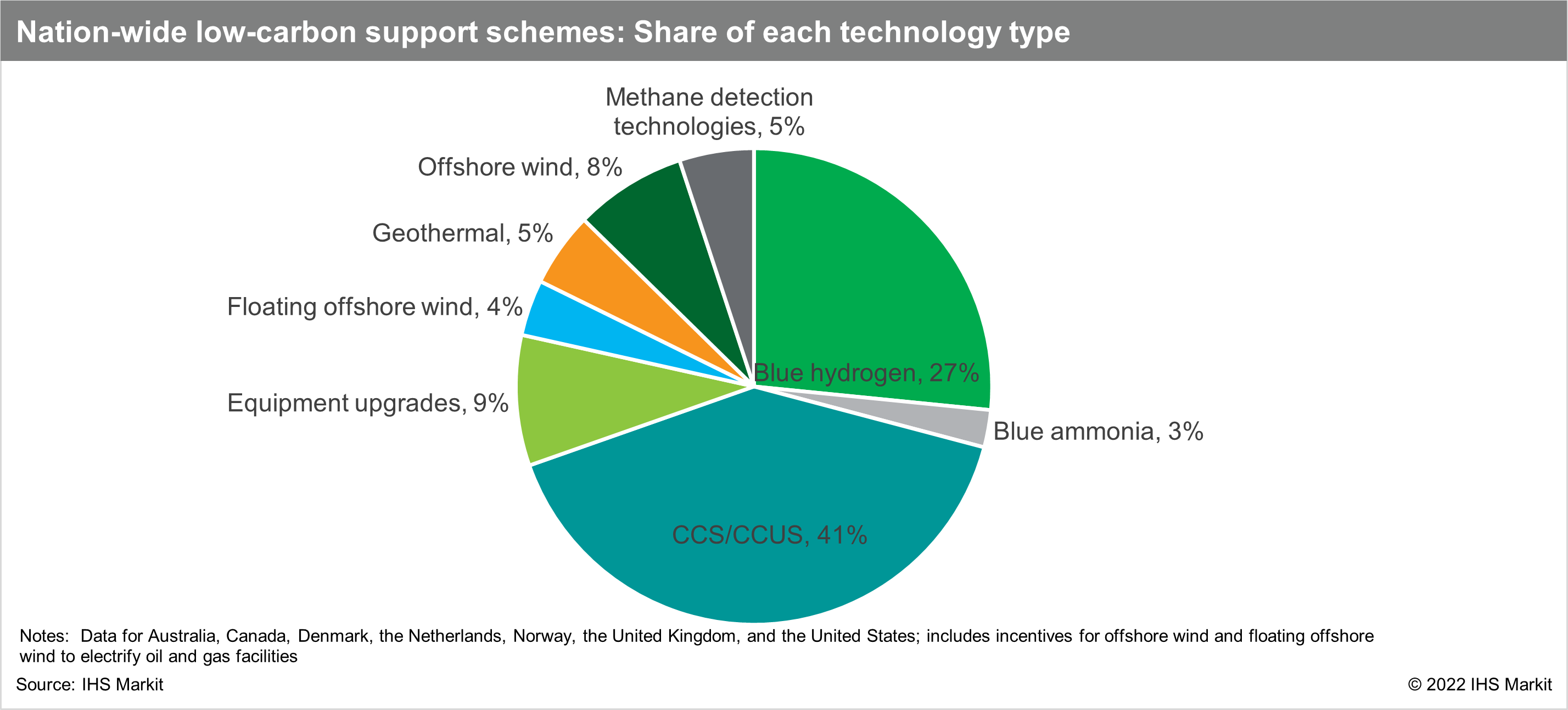

Governments Increasingly Adopt Incentive Schemes To Encourage Decarbonization Of The Oil And Gas Industry Ihs Markit